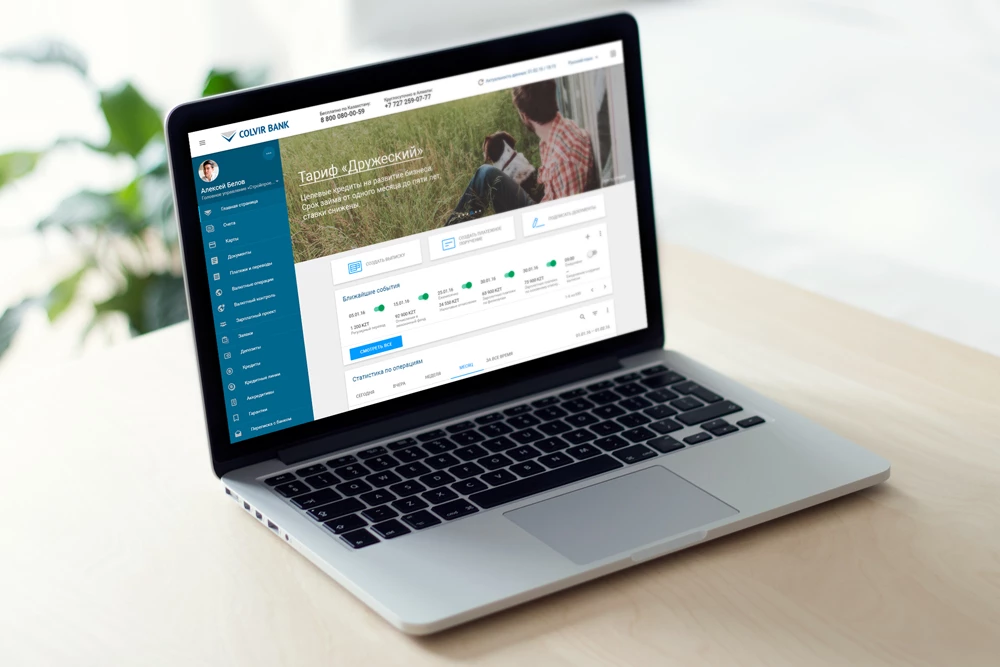

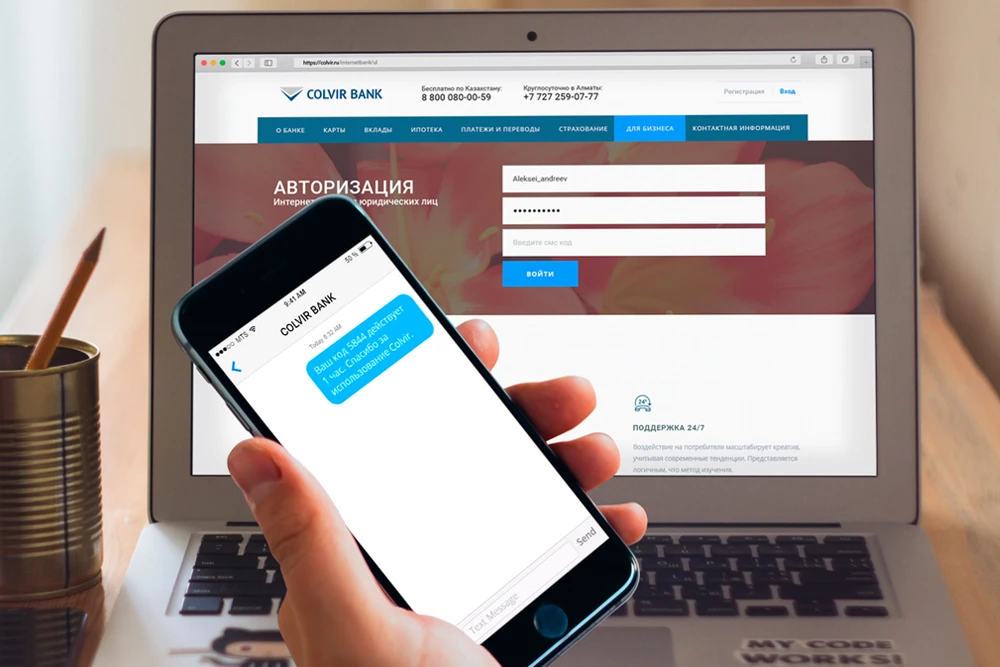

Colvir Internet Banking solution provides a channel for remote delivery of banking services to your legal entity customers. Our solution facilitates relieving branch queues, attracting new customers, keeping up with the times and delivering to your customers up-to-date service experience. This helps to optimize costs, raise productivity and leverage digital channels for proactive selling. The Internet Banking solution functionality scope includes account, payment, contract, credit card and forex controls operations. The Colvir solution is distinguished by its high implementation speed thanks to its seamless integration with the Core Banking System. The Internet Banking solution is subject to regular updates and enables user banks to offer to their customers advanced technology services.

Internet Banking

Product advantages

Services

The Internet Banking solution ensures that the Bank is in a position to deliver to its customers services of high quality without the need for the customers to pay a personal visit to the Bank: monitoring financial flows, a user-friendly facility for handling documents and prompt user notification of relevant events: incoming messages, mailshots, alerts to errors in documents.

Interface

The Internet Banking solution offers a state-of-the-art adaptive graphical user interface-opti.

Seamless CBS integration

Thanks to the solution integration to Colvir CBS, it can be implemented within a minimum space of time with minimum resources.

Architecture and Technology

The solution makes use of the current versions of its technology components ensuring high performance and fault tolerance. Support of multi-lingual interface and multi-lingual data is ensured. Comprehensive branding capability is offered: elements displayed on screen can be easily modified.

implemented projects

"Colvir Core Banking System was installed in our Bank back in 2014, and the Internet Banking for Legal Entities solution was implemented in 2015. Over the years of its use the business Internet Banking module has proved itself as a much in-demand solution that spans a vast proportion of user requirements. As a result of proactive and regular product updates by the vendor, implementation of new solutions embracing latest fintech development trends in 2019 Bai-Tushum Bank migrated to the upgraded version of Colvir Internet Banking for Legal Entities solution offering additional features and an improved interface. The Bai-Tushum Internet Banking solution was recognized as the best Internet Banking offering in Kyrgyzstan in 2019 and 2020. The Bank was awarded such assessment based on the outcome of a research exercise and vote undertaken by the SME Banking Club business Internet Banking expert panel for the CIS and Caucasus countries."

Outcome

-

Fast service delivery and reduced service costs

Speed up processing of customer requests, reduce office expenses and optimize loading of branch front office staff -

Increased fee income and expanded customer base

Make targeted product offers to your customers on the banner tape, and also attract new clients by promoting remote service delivery channel features -

A reputation of an up-to-date and technology-savvy bank

Keep up with the current trend of banking service delivery by offering to your clients a broad range of online services

Other colvir products

Advantages Colvir Software Solutions

Reliability

100% successful Projects

Simplicity

Product modules are independent of the kernel

Spot-on Relevance

International practice focused on banking products and services

Great Potential

We invest 100% of our earnings in further system development

Popularity

Localized throughout CIS

User-Friendliness

Flexible and customer-oriented

Any questions left?

Submit your request right now — our consultant will get in touch with you soonest, and will tell you about Colvir products in more detail