ISO 20022 is a new SWIFT standard for electronic exchange of data among financial and trade market participants that facilitates common data interpretation and understanding in the payment domain. The standard is an open one with its documentation available in the public domain at a special site (https://www.iso20022.org/). By the end of 2025 ISO 20022 will become the global standard for payments. As far as SWIFT interaction is concerned, it will impact the use of category 1, 2 and 9 MT formats that will be replaced with MX formats.

ISO 20022

The Advantages of Using МХ Formats

Improved data interchange as compared with the MT equivalent

Quality data meet long-term requirements of customers who need more information with regard to wire transfers included in each transfer order. This is also good news for risk managers and regulators who require additional guarantees

Extended features

The new format offers data content that is more structured facilitating for business managers faster creation of innovative banking products as compared with MT

Raised efficiency

The standard brings about an increase of the end-to-end STP rates and a reduction in the number of erroneous responses due to low data quality that create payment exchange risks

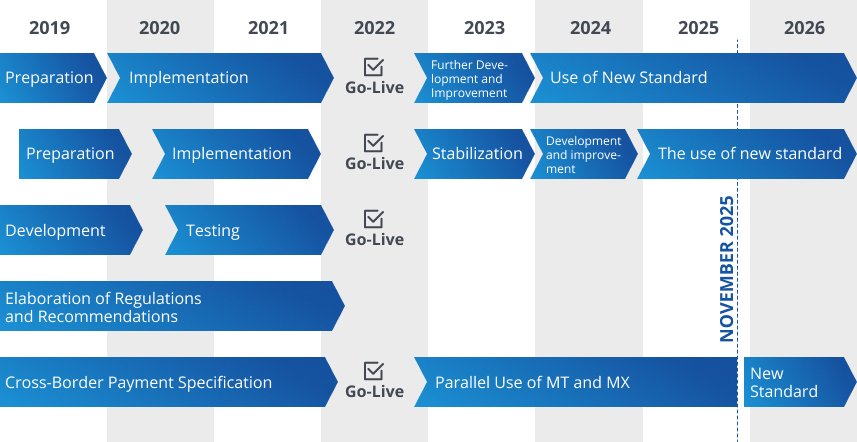

Worldwide project Timelines

UK

USA

European Central Bank

European Clearing Centre

SWIFT

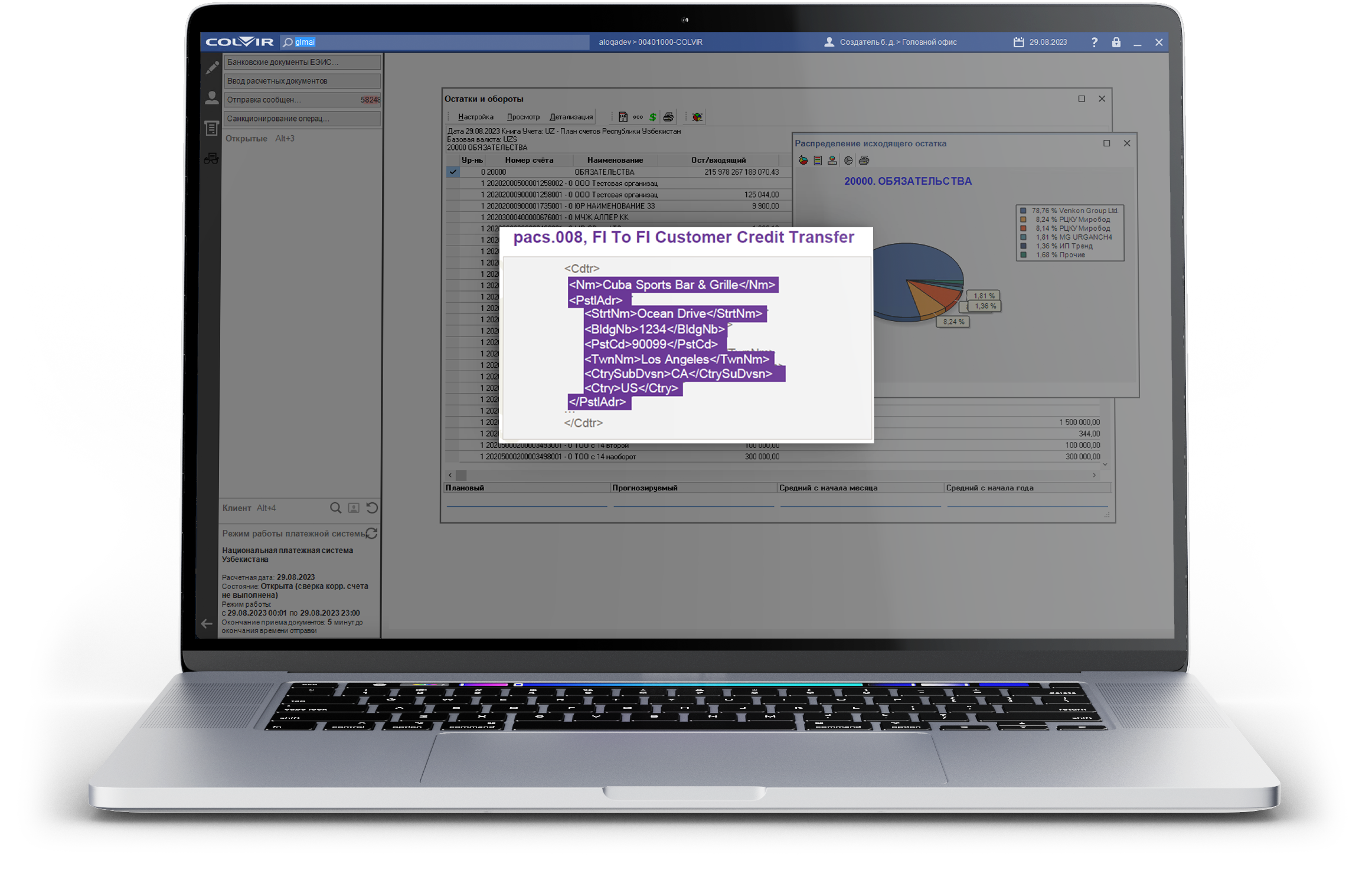

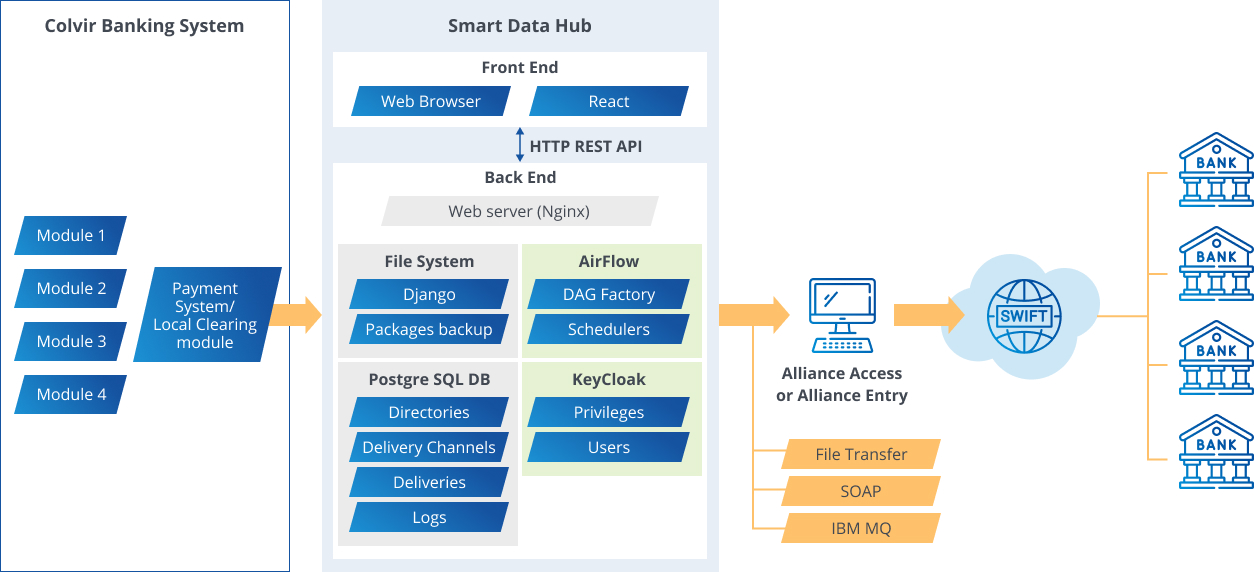

Colvir Solution

The updated Payment System/Local Clearing module, part of Colvir Core Banking System, is an ideal solution for migration to the new standard – it supports interaction patterns and formats developed by CBPR+, supports parallel use of МТ and МХ standards, and ensures processing of all payment types in different countries and regions including transactions with branches and correspondent banks.

Solution Advantages

- Support of the new МХ format.

- Unified interfaces for handling orders, requests, statements, confirmations, payments, investigations.

- A single mechanism for settlement reconciliation and payment matching.

- A simplified input of primary documents for international settlements.

- Extended functional features for automatic processing of confirmations, statement lines and payments.

- Module adaptability to change: there is no need to modify the interface or processing algorithms when connecting to new payment system types.

Solution Architecture

Other colvir products

Advantages Colvir Software Solutions

Reliability

100% successful Projects

Simplicity

Product modules are independent of the kernel

Spot-on Relevance

International practice focused on banking products and services

Great Potential

We invest 100% of our earnings in further system development

Popularity

Localized throughout CIS

User-Friendliness

Flexible and customer-oriented

Any questions left?

Submit your request right now — our consultant will get in touch with you soonest, and will tell you about Colvir products in more detail