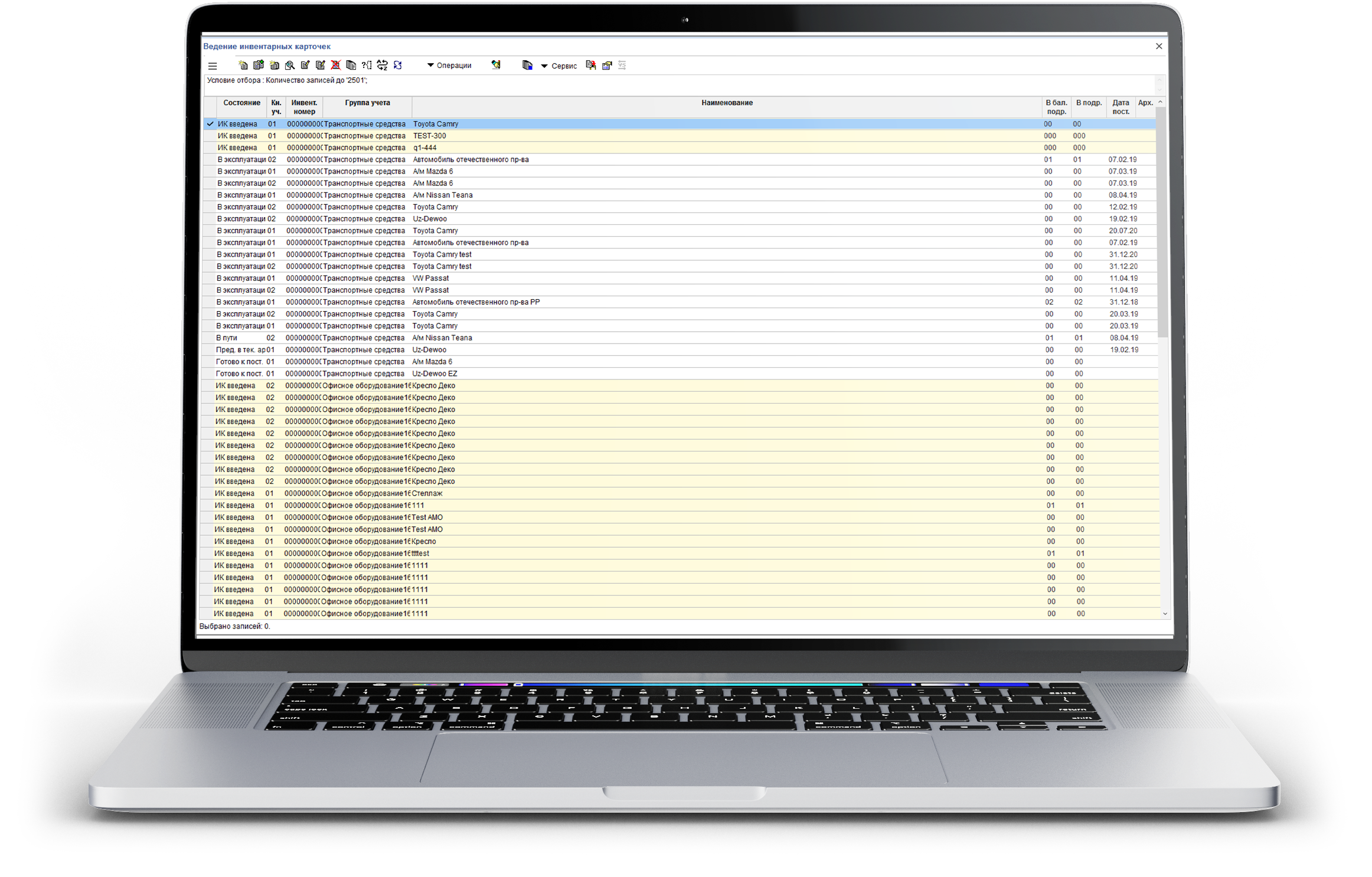

Inventory Record Management

Fixed and intangible asset record accounting spanning their complete lifecycle from the time of their acquisition to the time of their retirement taking into account changes in their value, their overhaul costs, and so on. Tracking of fixed asset movements: their receipt, transfers and retirement.

Parallel Accounting

Depending on the accounting purpose and method, the same fixed asset may be accounted for differently, such as different ledger-wise (tax accounting ledger, management accounting ledger, off system accounting ledger, etc.), as well as have different attributes within the scope of different accounting ledgers.

Directories and Reports

Reference data management. Requisite report generation.

Operations on Fixed Assets

Accounting for fixed asset leasing on long-term or current basis. Facility to split frixed assets into a number of independent accounting objects. Depreciation accrual using different methods. Accounting for modernization expenses including inventory utilization, routine fixed asset repairs and overhauling. Fixed asset revaluation.

Off-System Accounting

Off-system fixed asset accounting in case the useful life period has ended and the asset is written off the balance sheet, but its use however continues.

Stock Taking

The Stock Taking optional sub-module facilitates comparing actual property availability data as on a particular date with accounting data. The application also supports importation of files containing property descriptions to facilitate matching against fixed assets details in the accounting system, as well as downloading data into file for use on a data collection terminal in the course of stock taking.