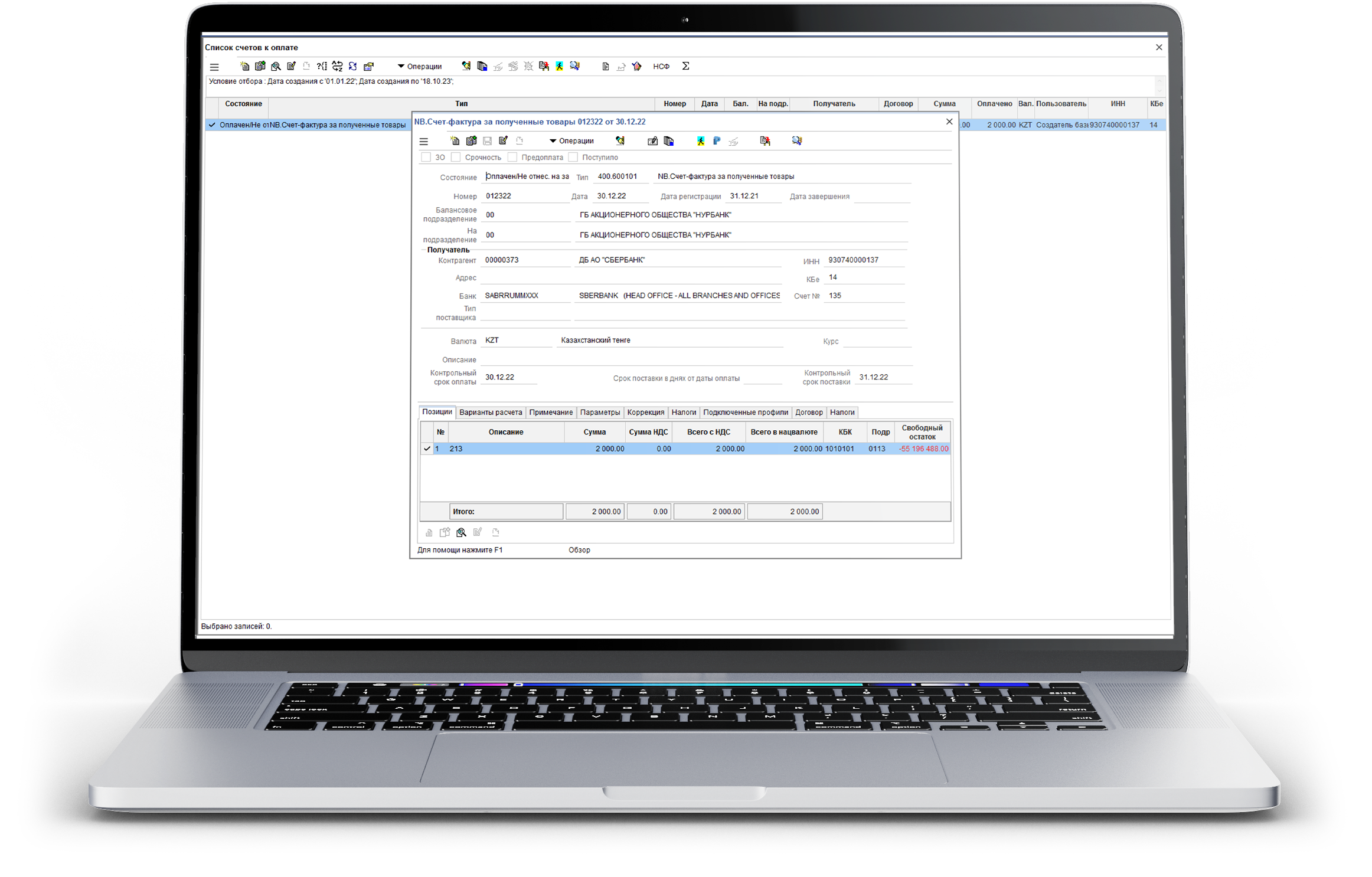

Payment Document Generation

Generation of documents to effect payment for goods and services delivered by counterparties. Document creation can be automatic contract-based, as well as manual.

Settlement with Imprest Account Holders

Order generation for business trips, as well as disbursement of funds to imprest account holders for admin expenses Advance report generation, expense accounting . Settlements with imprest account holders pertaining to the use of corporate cards.

Receiving Payments Against Documents

Incoming payment monitoring, automatic matching of payments against receivable invoices. Posting the statuses of payments for goods and services to the relevant contract schedule. Generation and processing of documents pertaining to shipment of goods and delivery of services to counterparties.

Payment Against Documents

Payment against documents with balance sheet entry generation. VAT accounting Reflection of payments for goods and services In the schedule of the respective contract in the Contract Management module Posting of amounts spent (amounts paid against documents) to expenditures. Tax invoice generation.

Receivables Report Generation

Report generation and collection of payments for goods and services delivered to counterparties. Document generation can be performed either automatically contract-based, or in manual mode.

Obligation Performance Monitoring

Accounting for penalties, debts and revenues pertaining to accounts receivable. Posting to past due of debts pertaining to accounts receivable. Facility to write off bad debts pertaining to accounts receivable.